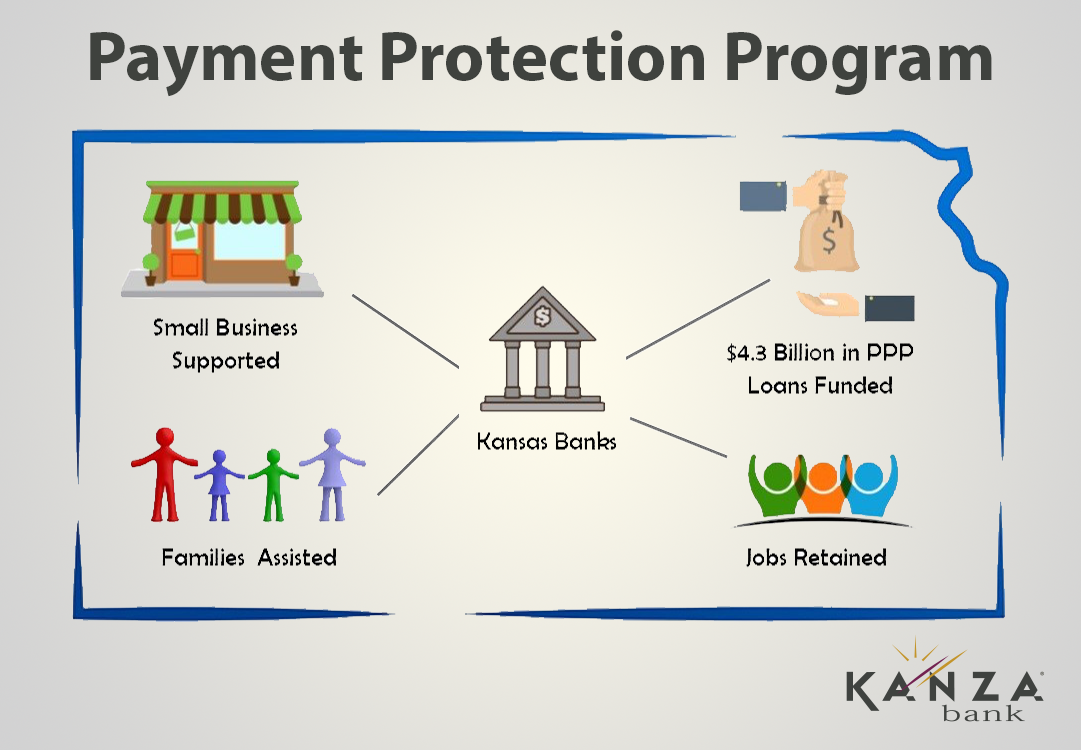

PAYCHECK PROTECTION PROGRAM

The U.S. Department of the Treasury Paycheck Protection Program provides economic relief for small businesses with 500 or fewer employees. KANZA Bank is committed to helping our customers and communities through the application process.

Information from the U.S. Treasury

- - US Treasury Small Business Paycheck Protection Program Overview

- - US Treasruy Small Business Paychek Protection Program Information Sheet

- - Paycheck Protection Program Frequently Asked Questions

- - PPP Interim Final Rule

Required Documents

Business Entities (Corp/LLC/etc.)

- SBA Borrower Paycheck Protection Program Application

- Legal Entity Beneficial Ownership Certification Form

- Copy of Driver's License(s)

- Borrower entity documents: Articles of Incorporation; Operating Agreement; Partnership Documents; By-Laws; Trust Documents; Etc. (existing KANZA Bank customers will not need to resubmit this information)

- Payroll tax filings reported to the IRS

- Paycheck Protection Program Loan Amount Worksheet and FTE Count

- Deposit account info for the disbursements of funds

- Brief description of the nature of business

Addtional documentation may be required to include but not limited to:

- If franchise - Franchise Agreement and SBA Franchise addendum may be required

- Any other documents the SBA determines necessary

For forgiveness requests:

- Payroll expenses for year-to-date 2019 to be documented via:

- payroll tax fillings reported to the IRS

-State income, payroll, and unemployment insurance filings

-Canceled checks, payment receipts, transcripts of accounts, or any other documentation verifying payments on payroll (tax filings), covered interest on mortgage obligations, payments on covered lease obligations, and utility bills (Date of Loan - June 30, 2020)

Self-employeed Individuals (Schedule C filers)

- SBA Borrower Paycheck Protection Program Application

- Legal Entity Beneficial Ownership Certification Form

- Copy of Driver's License(s)

- 2019 Schedule C - required to be 2019, even if it has not been filed for the year

- 1099 for contract labor

- 941's for self-employed with W2 payroll employees

- Borrower entity documents: Articles of Incorporation; Operating Agreement; Partnership Documents; By-Laws; Trust Documents; Etc. (existing KANZA Bank customers will not need to resubmit this information)

- Paycheck Protection Program Loan Amount Worksheet for Self-Employed

- Deposit account info for the disbursement of funds

- Brief description of the nature of business

For forgiveness request

- Refer to pages 11-14 of the Interim Final Rule