Disclosures

Terms & Conditions of Your Account

DEFINITIONS. Throughout this Agreement, the terms “you,” “your,” and “account owner” refer to the customer whether or not there are one or more Customers named on the account, and the terms “we,” “our,” and “us” refer to the Bank, KANZA BANK. The acronym “NOW” means Negotiable Order of Withdrawal.

GENERAL AGREEMENT. You understand that the following Account Agreement (“Agreement”) governs your NOW account with us, along with any other documents applicable to your account, including all account opening disclosures that have been provided to you, which are incorporated by reference. You understand that your account is also governed by applicable law.

The account opening disclosures include a schedule of fees and charges applicable to the account, the interest rate(s) and applicable Annual Percentage Yield, compounding and crediting of interest, minimum balance requirements, and other pertinent information related to the account. The information found in the account opening disclosures may change from time to time in our sole discretion. If the fees, charges, minimum balance requirements, or other items change in a manner that would adversely affect you, we will provide you with written notice 30 days prior to the change. By providing a written or electronic signature on the Account Information document or other agreement to open your account, or by using any of our deposit account services, you and any identified account owners agree to the terms contained in this Account Agreement.

YOUR CHOICE OF ACCOUNT. You have instructed us as to the title and type of the account that you have chosen. You acknowledge that it is your sole responsibility to determine the full legal effect of opening and maintain the type of account you have chosen. We have not set forth all laws that may impact your chosen account. For example, there are conditions that may need to be satisfied before transferring accounts due to death or other events as well as reductions to an account required or permitted by law, we assume no legal responsibility to inform you as the effect of your account choice on your legal interests.

INDIVIDUAL ACCOUNT. The named party in an individual account owns the account and may withdraw all or some of the account. On the death of the party, ownership passes as part of the party’s estate.

TRANSFERS AND ASSIGNMENTS. We may assign or transfer any or all of our interest in this account. You cannot assign or transfer any interest in your account unless we agree in writing.

POWER OF ATTOURNEY. If you wish to name another person to act as your attorney in fact or agent in connection with your account we must approve the form of appointment.

RESTRICTIVE LEGENDS. We are not required to honor any restrictive legend on checks you write unless we have agreed to the restriction in writing signed by an officer of the Bank. Examples of restrictive legends are “two signatures required”, “must be presented within 90 days” or “not valid for more than $1,000.00.”

STALE OR POSTDATED CHECKS. We reserve the right to pay or dishonor a check more than six (6) months old without prior notice to you. You agree not to postdate any check drawn on the account. If you do, and the check is presented for payment before the date of the check, we may pay it or return it unpaid. We are not liable for paying any stale or postdated check. Any damages you incur that we may be liable for are limited to actual damages not to exceed the amount of the check.

PREAUTHORIZED CHECKS OR DRAFTS. You should guard information about your account (such as your routing number and your account number) as carefully as you would guard your blank checks. If you voluntarily give such information about your account to a party which is seeking to sell you goods or services, without physically delivering a check to that party, any debit to or withdrawal from your account it initiates will be deemed authorized by you.

VERIFYING FUNDS AVAILABLITY FOR CHECK. You authorize us to release funds availability information about your account to individuals or merchants who represent to us that they have received a check from you.

CHECK SAFEKEEPING. If you utilize a check safekeeping system or any other system offered by us for the retention of your checks, you understand that the canceled checks will be retained by us and destroyed after a reasonable time period or as required by law. Any request for a copy of a check may be subject to a fee, as indicated in the Schedule of Fees or Disclosures and as allowed by law. If for any reason we cannot provide you with a copy of a check, our liability will be limited to the lesser of the face amount of the check or the actual damages sustained by you.

SUBSTITUTE CHECKS. To make check processing faster, federal law permits financial institutions to replace original checks with “substitute checks.” These substitute checks are similar in size to the original items with a slightly reduced image of the front and back of the original item. The front of a substitute check states: “this is a legal copy of your check. You can use it the same way you would use the original check.” You may use a substitute check as proof of payment just like the original item. Some or all of the items that you receive back from us may be substitute checks.

WITHDRAWLS. Deposits will be available for withdrawal consisted with the terms of the Disclosures. Withdrawals may be subject to a service charge.

DEPOSITS. Deposits may be made in person, by mail, or in another from and manner as agreed by us in our sole discretion. We are not responsible for transactions mailed until we actually receive and record them. We may in our sole discretion refuse to accept particular instruments as a deposit to your account. Cash deposits are credited to your account according to this Agreement. Other items you deposit are handled by us according to our usual collection practices. If an item you deposit is returned unpaid, we will debit your account for the item and adjust any interest earned. You are liable to us for the amount of any check you deposit to your account that is returned unpaid and all costs and expenses related to the collection of all or part of such amount from you. Funds deposited to your account, excluding any Time Deposit accounts, are available in accordance with the Disclosures.

COLLECTION OF DEPOSITED ITEMS. In receiving items for deposit or collection, we act only as your agent and assume no responsibility beyond the exercise of ordinary care. All items are credited subject to final settlement in cash or credits. We shall have the right to forward items to correspondents including all Federal Reserve Banks, and we shall not be liable for default or neglect of said correspondents for loss in transit, nor shall any correspondent be liable except for its own negligence. You specifically authorize us or our correspondents to utilize Federal Reserve Banks to handle such items in accordance with provisions of Regulation J (12 CFR Part 210), as revised or amended from time to time by the Federal Reserve Board. In the event we are subject to local clearinghouse rules, you specifically authorize us to handle such items in accordance with the rules and regulations of the clearinghouse.

If we permit you to withdraw funds from your account before final settlement has been made for any deposited item, and final settlement is not made, we have the right to charge your account or obtain a refund from you. In addition, we may charge back any deposited item at any time before final settlement for whatever reason. We shall not be liable for any damages resulting from the exercise of these rights. Except as may be attributable to our lack of good faith or failure to exercise ordinary care, we will not be liable for dishonor resulting from any reversal of credit return of deposited items or for any damages resulting from any of those actions.

STATEMENTS. We will provide you with a periodic statement showing the account activity. The last address you supply us in writing will be deemed the proper address for mailing this statement to you. The account holder who receives this statement is the agent of his/ her co-account holder(s) for purposes of receiving the statements and items. You must exercise reasonable care in reviewing your statement and reasonable promptness in notifying us of any discrepancies, such as alterations or forged unauthorized signatures, even if by the same wrongdoer. Reasonable promptness will not exist if you fail to notify us within 30 days after mail or otherwise make the statement available to you. If you fail to notify us of any discrepancies with reasonable promptness, your right to assert such discrepancies will be barred or limited to the extent permitted by law. Additionally, you agree that we will not be liable for discrepancies reported to us after one year after we mail or otherwise make the statement available to you, even if we failed to exercise ordinary care. However, if the discrepancy is the result of an electronic fund transfer, the provisions of the Disclosures will control its resolution. If you do not receive a statement from us because you have failed to claim it or have supplied us with an incorrect address, we may stop sending your statements until you specifically make written request that we resume sending your statements and you supply us with a proper address.

ACH AND WIRE TRANSFERS. This agreement is subject to Article 4A of the Uniform Commercial Code- Funds Transfers as adopted in the state of Kansas. If you send or receive a wire transfer, you agree that the Fedwire® Funds Service may be used. Federal Reserve Board Regulation J is the law that covers transaction made over Fedwire® Funds Service. When you originate a funds transfer for which Fedwire® Funds Services is used, and you identify by name and number a beneficiary financial institution, an intermediary financial institution or a beneficiary, we are every receiving or beneficiary institution may rely on the identifying number to make payment. We may rely on the number even if it identifies a financial institution, person or account other than the one named.

If you are a party to an Automated Clearing House (“ACH”) entry, you agree that we may transmit an entry through the ACH, and you agree to be bound by the National Automated Clearing House Association (“NACHA”) Operating Rules and Guidelines, the rules of any local ACH, and the rules of any other systems through which the entry is made.

PROVISIONAL PAYMENT. Credit we give you is provisional unit we receive full settlement for that entry. If we do not receive final settlement, you agree that we are entitled to a refund of the amount credited to you in connection with the entry, and the party making payment to you via such entry (i.e., the originator of the entry) shall not be deemed to have paid you in the amount of such entry.

INTERNATIONAL ACH TRANSACTIONS. If your transaction originated from a financial agency that is outside of the territorial jurisdiction of the United States, it may be subject to additional review for compliance with the rules of the Office of Foreign Assets Control (OFAC). If additional review is required, the International ACH transaction will not be available to you until it passes final verification.

NOTICE OF RECEIPT. We will not provide you with notice of our receipt of the order, unless we are so requested the transfer originator in the order. However, we will continue to notify you of the receipt of payments in the periodic statements we provide to you.

CHOICE OF LAW. We may accept on your behalf payments to your account which have been transmitted, that are not subject to the Electronic Fund Transfer Act, and your rights and obligations with respect to such payments shall be constructed in accordance with and governed by the laws of the state where we are located.

YOUR RESPONSIBILITY FOR BACK OF CHECK. All negotiable paper (“checks”) presented for deposit must be in a format that can be processed and we may refuse to accept any check that does not meet this requirement. All endorsements on the reverse side of any check deposited into your account must be placed on the left side of the check when looking at it from the front, and the endorsements must be placed so as not to go beyond an area located 1-1/2 inches from the left edge of the check when looking at it from the front. It is your responsibility to ensure that these requirements are met and you are responsible for any loss incurred by us for failure of an endorsements to meet this requirement.

STOP PAYMENTS. You may stop payment on a check drawn against your account by a record or written order or other confirmation as allowed by us, provided that we receive the Stop Payment Order in a time and manner that gives us a reasonable opportunity to act on it. The Stop Payment Order must describe the item or account with reasonable certainty. Oral requests for a Stop Payment Order are binding on us for 14 calendar days only, and must be confirmed by you in a record or writing within that period. If the record or written confirmation is not received as specified, we will no longer be bound by your request. Upon receipt of confirmation in a record or writing, a Stop Payment Order on a check remains in effect for six months or until we receive a record or writing revoking the Stop Payment Order, whichever occurs first. If the item on which a Stop Payment Order has been placed has not cleared or been returned to you by the payee, you may renew the Stop Payment Order for an additional six months by providing a request to us in a record or writing within the time period the Stop Payment Order is in effect. A Stop Payment Order on an EFT debit will remain in effect until the earlier of 1) your withdrawal of the Stop Payment Order, or 2) the return of the debit entry, or, where a Stop Payment Order is applied to more than one debit entry under a specific authorization involving a specific payee (Originator), the return of all such debits. When a stop is placed on a multiple debit entry transfer, we may require your confirmation in a record or writing stating that you have canceled your authorization for the transfer with the payee (a Stop Payment Order does not revoke authorization). You will be charged a fee every time you request a Stop Payment Order, and for each Stop Payment Order renewal you make. You understand that we may accept the Stop Payment Order request from any of the authorized signers of the account regardless of who signed the check. A release of the Stop Payment Order may be made only by the person who initiated the stop payment request. Our acceptance of a stop payment request does not constitute a representation by us that the item has not already been paid or that we have had a reasonable opportunity to act on the request.

A Stop Payment Order may be placed on either a one-time transfer or on a multiple debit entry transfer. If you request a stop payment on a multiple debit entry transfer, we must receive the Stop Payment Order, orally or in a record or writing, at least three business days before a scheduled multiple debit entry. If the Stop Payment order is requested for an Electronic Check Conversion or other one-time transfer, we must receive the request, orally or in a record or writing, in a period of time that provides us a reasonable opportunity to act on it prior to acting on the debit entry, otherwise this Stop Payment Order shall be of no effect. Oral stop payment orders are binding on us for 14 calendar days only, and must be confirmed by you in a record or writing within that period.

The Stop Payment Order shall be governed by the provisions of the Uniform Commercial Code 4A in effect in the state in which we are located, the Electronic Fund Transfer Act (Regulation E), NACHA Operating Rules, and any applicable state law.

We have a daily cutoff time by which we must receive any knowledge, notice, Stop Payment Order, set-off or legal process affecting our right or duty to pay a check. That cutoff time is one hour after the opening of your branch’s banking day, following the banking day on which your branch received the check.

DEATH OR INCOMPETENCY. Neither your death nor a legal adjudication of incompetence revokes our authority to accept, pay, or collect items until we know of the fact of the death or of an adjudication of incompetence and have a reasonable opportunity to act on it. To the extent permitted by law, even with knowledge, we may for 10 days after the date of death, pay checks drawn on or before the date of death unless ordered to stop payment by a person claiming an interest in the account.

NON-SUFFICIENT FUNDS. If your account lacks sufficient available funds to pay a check, preauthorized transfer or other debit activity presented for payment, we may return such item for non-sufficient funds and may charge you a fee as provided in the fee schedule, subject to our Overdraft policy, and if applicable, to any overdraft protection plan you have consented to in writing with us. Regardless, our handling of the item may subject your account to a fee. We will process checks and other debit items in the order identified in your Truth In Savings Disclosure.

SIGNATURES. Your signature on the Account Information document is your authorized signature. You authorize us, at any time, to charge you for all checks, drafts or other orders for the payment of money, that are drawn on us regardless of by whom or by what means your signature may have been affixed so long as the signature resembles the signature specimen in our files. For withdrawal and other purposes relating to any account you have with us, we are authorized to recognize your signature; and we will not be liable to you for refusing to honor signed instruments or instructions if we believe in good faith that one or more of the signatures appearing on the instrument or instructions is not genuine.

Further, most checks, and other items are processed automatically, i.e., without individual review of each item. Therefore, unless we agree in a separate writing, in our sole discretion, upon your request and due to unique circumstances to conduct individual review of each item, you agree that we are acting within common and reasonable banking practices by automatically processing checks, and other items, i.e., without individual review of each check, or item. You agree to indemnify, defend, and hold us harmless from and against all loss, costs, damage, liability, and other injury (including reasonable attorney fees) that you or we may suffer or incur as a result of this practice.

PAYMENT OF INTEREST. Interest will be calculated and paid in accordance with the Disclosures provided to you at the time you opened the account.

FEES, SERVICE CHARGES, AND BALANCE REQUIREMENTS. You agree to pay us and are responsible for any fees, charges or balance/deposit requirements as provided in the Disclosures provided to you at the time you opened the account. Fees, charges and balance requirements may change from time to time. We also reserve the right to impose a service charge for cashing checks drawn on your account if the person cashing the check is not a customer of this Bank.

WITHDRAWAL NOTICE REQUIREMENTS. We have the right to require seven days prior written notice from you or your intent to withdraw any funds from your account.

SET-OFFS AND SECURITY INTEREST. If you ever owe us money as a borrower, guarantor or otherwise, and it becomes due, we have the right under the law (called “set-off”) and under this Agreement (by which you grant us a security interest in your deposit account and any other accounts held by you) to use your account funds to pay the debt, where permitted by law. If your account is held jointly, that is, if there is more than one account owner, we may offset funds for the debt of any one of the joint owners. Similarly, we may also set-off funds from the individual accounts of any one of the joint owners to satisfy obligations or debts in the joint account. The security interest granted by this Agreement is consensual and is in addition to our right of set-off.

CLAIMS. In response to any garnishment, attachment, restraining order, injunction, levy, citation to discover assets, judgment, reclamation, other order of court or other legal process (“Claim(s)”), we have the right to place a hold on, remove from your account(s) and/or remit to the designated third-party(ies) any amount on deposit in your account(s) as set forth in and required by such Claim(s). If the account(s) is/are held jointly, we may place the hold, remove from the account(s) and/or remit the amounts from the account(s) any fee authorized by law in connection with the Claim(s) or as otherwise set forth in the Disclosures.

DORMANT ACCOUNTS. You understand that if your account is dormant or inactive, your account if interest-bearing will continue to earn interest and we may charge fees specified in the Disclosures, to the extent permitted by the law. You agree that we are relieved of all responsibility if your account balance is escheated (that is, turned over to the state) in accordance with the state law.

ATTORNEYS’ FEES AND EXPENSES. You agree to be liable to us for any loss, costs or expenses, including reasonable attorneys’ fees to the extent permitted by law, that we incur as a result of any dispute involving your account, and you authorize us to deduct any such loss, costs or expense from your account without prior notice to you. This obligation includes disputes between yourself and us involving the account and situations where we become involved in disputes between you and an authorized signer, another joint owner, or a third party claiming interest in the account. It also includes situations where you, an authorized signer, another joint owner, or a third party takes action with respect to the account that causes us, in good faith, to seek the advice of counsel, whether or not we actually become involved in a dispute.

LEGAL PROCESS AGAINST ACCOUNT. You agree to be responsible for, to reimburse us, and/or have your account charged for any expenses or reasonable attorney fees we incur due to an attachment, garnishment, levy or subpoena of records of your account. Any garnishment or other levy against your account is subject to our right of set-off and security interest. We may restrict the use of your account if it is involved in any legal proceeding.

CLOSING ACCOUNT. We may close the account at any time, with or without cause, after sending you notice as required by the law. At our discretion, we have the authority to pay an otherwise properly payable check, which is presented after the closing of your account. Such a termination will not release you from any fees or other obligations incurred before the termination. We will send a check for the balance in our possession to which you are entitled.

OUR WAIVER OF RIGHTS. You understand and agree that no delay or failure on our part to exercise any right, remedy, power or privilege available to us under this Agreement shall affect or preclude our future exercise of that right, remedy, power or privilege.

YOUR WAIVER OF NOTICE. By signing the signature card/Account Information form, you waive any notice of non-payment, dishonor or protest regarding any items credited to or charged against your deposit account. For example, if a check that you deposited is dishonored and returned to us, we are not required to notify you of the dishonor.

NOTICE. You are responsible for notifying us of any address or name changes, death of an account holder, or other information affecting your account. Notices must be in a form and manner acceptable to us with enough information to allow us to identify the account. Notice sent by you to us is not effective until we have received it and have had a reasonable opportunity to act upon it. Written notice sent by us to you is effective when mailed to the last address supplied.

AMENDMENTS AND ALTERATIONS. You agree that the terms and conditions governing your account may be amended by us from time to time. We will notify you of amendments as required by applicable law. Your continued use of the account evidences your agreement to any amendments. Notices will be sent to the most recent address shown on the account records. Only one notice will be given in the case of joint account holders.

EFFECTIVE APPLICABLE LAWS AND REGULATIONS. You understand that this Agreement is governed by the laws of Kansas, except to the extent that federal law is controlling. Changes in these laws and regulations may modify the terms and conditions of your account(s). We do not have to notify you of these changes, unless required to do so by law. If any of the terms of this Agreement cone into conflict with the applicable law and are declared to be invalid or unenforceable, those terms will be nullified to the extent that they are inconsistent with the law and the applicable law will govern. However, this shall not affect the validity of the remaining provisions.

NOTICE OF POTENTIONAL DISCLOSURE OF NEGATIVE INFORMATION TO CONSUMER REPORTING AGENCIES

Electronic Fund Transfers — Your Rights & Responsibilities

Indicated below are types of Electronic Fund Transfers we are capable of handling, some of which may apply to your account. Please read this disclosure carefully because it tells you your rights and obligations for the transactions listed. You should keep this notice for future reference.

Electronic Fund Transfers Initiated By Third Parties – You may authorize a third party to initiate electronic fund transfers between your account and the third party’s account. These transfers to make or receive payment may be one-time occurrences or may recur as directed by you. These transfers may use the Automated Clearing House (ACH) or other payments network. Your authorization to the third party to make these transfers can occur in a number of ways. For example, your authorization to convert a check to an electronic fund transfer or to electronically pay a returned check charge can occur when a merchant provides you with notice and you go forward with the transaction (typically, at the point of purchase, a merchant will post a sign and print the notice on a receipt). In all cases, these third party transfers will require you to provide the third party with your account number and financial institution information. This information can be found on your check as well as on a deposit or withdrawal slip. Thus, you should only provide your financial institution and account information (whether over the phone, the Internet, or via some other method) to trusted third parties whom you have authorized to initiate these electronic fund transfers. Examples of these transfers include, but are not limited to:

- Preauthorized credits – You may make arrangements for certain direct deposits to be accepted into your checking or savings.

- Preauthorized payments – You may make arrangements to pay certain recurring bills form your checking or savings.

- Electronic check conversion – You may authorize a merchant or other payee to make a one-time electronic payment from your checking account using information from your check to pay for purchases or pay bills.

- Electronic returned check charge – you may authorize a merchant or other payee to initiate an electronic funds transfer to collect a charge in the event a check is returned for insufficient funds.

Bank-By-Phone transactions – types of transactions – You may access your account by telephone using your account number(s), personal identification number (PIN) and touch tone phone to:

- transfer funds from Checking, savings to Checking, savings, loan

- get balance information about checking, savings, certificate of deposit, line of credit or Individual Retirement Accounts

- get withdrawal history about checking or savings

- get deposit history about checking or savings

You may access you account for telephone transactions at the following number(s) and during the following hours:

- (620) 532-5123 (12:00 AM to 12:00 AM)

- (877) 532-5145 (12:00 AM to 12:00 AM)

ATM Card transactions – types of transactions- You may access your account(s) by ATM using your ATM Card and your personal identification number (PIN) to:

- deposit funds to checking, savings or Money Market

- withdraw cash from checking, savings or Money Market

- transfer funds from any account to any account

- get balance information about checking, savings or Money Market

- Maximum per transaction withdrawal of $505 (including fees); Maximum daily withdrawal of $505.

Some of these services may not be available at all terminals.

Debit Card ATM transactions –types

of transactions- You may access your account(s) by ATM using

your Debit Card and your personal identification number

(PIN) (as applicable) to:

- deposit funds to checking, savings or Money Market

- withdraw cash from checking, savings or Money Market

- transfer funds from one account to another account

- get balance information about checking, savings or Money Market

- Maximum withdrawal per transaction of $505 (including fees); Maximum daily withdrawal of $505.

Some of these services may not be available at all terminals.

Debit Card point-of-sale transactions –

types of transactions- You may access your checking or your

Savings account(s) by debit card to do transactions that

participating merchants will accept, including:

- purchase goods in person, by phone, or online

- pay for services in person, by phone, or online

- get cash from a participating merchant or financial institution

- Maximum daily limit of $2,000.

On-Line Banking – types of transfers- You may access your accounts by computer at www.kanzabank.com and using your User ID and password to:

- transfer funds from any account to any account

- make payments from any account to any account (Must complete and submit an online banking application before usage of this product.)

- get balance information about checking, savings, certificate of deposit, line of credit or Money Market

- get withdrawal history about checking, savings, certificate of deposit, line of credit, or Money Market

- get deposit history about checking, savings, certificate of deposit, line of credit, or Money Market

- get transaction history about checking, savings, certificate of deposit, line of credit or Money Market

Bill payment service – types of

transfers-

You may access this service by computer at www.kanzabank.com

and using your user name and password.

Limits and fees – Please refer to

our fee disclosure for information about fees and limitations

that may apply to these electronic fund transfers.

ATM Operator/Network Fees – When

you use an ATM not owned by us, you may be charged a fee

by the ATM operator or any network used (and you may be

charged a fee for a balance inquiry even if you do not complete

a fund transfer).

DOCUMENTATION

Terminal Transfers –You

can get a receipt at the time you make a transfer to or

from your account using an automated teller machine or point-of–sale

terminal. However, you may not get a receipt if the amount

of the transfer is $15 or less.

Preauthorized credits – If you have

arranged to have direct deposits made to your account at

least once every 60 days from the same person or company:

- the person or company making the deposit will tell you every time they send us the money.

- you can call us at (620) 532-5821 to find out whether or not the deposit has been made.

Periodic statements – You will get

a monthly account statement from us for your checking account(s).

You will get a monthly account statement from us for your

savings account(s), unless there are no transfers in a particular

month. In any case, you will get a statement at least quarterly.

PREAUTHORIZED PAYMENTS

Right to stop payment and procedure for doing so

– If you have told us in advance to make regular payments

out of your account, you can stop any of these payments.

Here is how:

Call or write us at the telephone number or address listed

in this disclosure in time for us to receive you request

three business days or more before the payment is scheduled

to be made. If you call, we may also require you to put

your request in writing and get it to us within 14 days

after you call.

Notice of varying amounts – If these

regular payments may vary in amount, the person you are

going to pay will tell you, 10 days before each payment,

when it will be made and how much it will be. (You may choose

instead to get this notice only when the payment would differ

by more than a certain amount from the previous payment,

or when the amount would fall outside certain limits you

set.)

Liability for failure to stop payment of preauthorized

transfer – If you order us to stop one of

these payments three business days or more before the transfer

is scheduled, and we do not do so, we will be liable for

your losses or damages.

FINANCIAL INSTITUTION"S LIABILITY

Liability for failure to make transfers – If we do not complete a transfer to or from your account on time or in the correct amount according to our agreement with you, we will be liable for your losses or damages. However, there are some exceptions. We will not be liable, for instance:

(1) If, through no fault of ours, you do not have enough money in your account to make the transfer.

(2) If you have an overdraft line and the transfer would go over the credit limit.

(3) If the automated teller machine where you are making the transfer does not have enough cash.

(4) If the terminal or system was not working properly and you knew about the breakdown when you started the transfer.

(5) If circumstances beyond our control (such as fire or flood) prevent the transfer, despite reasonable precautions that we have taken.

(6) There may be other exceptions stated in our agreement with you.

CONFIDENTIALITY

We will disclose information to third parties about your account or the transfers you make:

(1) where it is necessary for completing transfers; or

(2) in order to verify the existence and condition of your account for a third party, such as a credit bureau or merchant; or

(3) in order to comply with government agency or court orders; or

(4) as described in our privacy policy disclosure, provided separately.

UNAUTHORIZED TRANSFERS

(a) Consumer liability. (1) Generally, tell us AT ONCE if you believe your card and/or code have been lost or stolen. Telephoning is the best way of keeping your possible losses down. You could lose all of the money in your account (plus your maximum overdraft line of credit). If you tell us within four business days, you can lose no more than $50 if someone used your card without your permission. (If you believe your card and/or code has been lost or stolen, and you tell us within four business days after you learn of the loss or theft, you can lose no more that $50 if someone used your card and/or code without your permission.)

If you do NOT tell us within four business days after you learn of the loss or theft of your card and/or code, and we can prove we could have stopped someone from using your card and/or code without your permission if you had told us, you could lose as much as $300.

Also, if your statement shows transfers that you did not make, tell us at once. If you do not tell us within 60 days after the statement was mailed to you, you may not get back any money you lost after the 60 days if we can prove that we could have stopped someone from taking the money if you had told us in time.

If a good reason (such as a long trip or a hospital stay) kept you from telling us, we will extend the time period.

(2) Additional Limits on Liability for MasterCard®

debit card, when used for point-of-sale transactions. You

will not be liable for any unauthorized transactions using

your MasterCard debit card, when used for point-of-sale

transactions, if: (i) you can demonstrate that you have

exercised reasonable care in safeguarding your card from

risk of loss or theft, (ii) you have not reported to us

two or more incidents of unauthorized use within the prior

twelve-moth period, and (iii) your account is in good standing.

If any of the conditions are not met, your liability is

the lesser of $50 or the amount of money, property, labor,

or services obtained by the unauthorized use before notification

to us. ‘Unauthorized use’ means the use of your

debit card by a person, other than you, who does not have

actual, implied, or apparent authority for such use, and

from which you receive no benefit. This additional limit

on liability does not apply to ATM transactions or to transactions

using your personal identification number which are not

processed by MASTERCARD.

(b) Contact in event of unauthorized transfer.

If you believe your card and/or code has been lost or stolen,

call or write us at the telephone number or address listed

in this disclosure. You should also call the number or write

to the address listed in this disclosure if you believe

a transfer has been made using the information from your

check without your permission.

ERROR RESOLUTION NOTICE

In case of errors or questions about your electronic transfers, call or write us at the telephone number or address listing in this disclosure, as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer listed on the statement or receipt. We must hear from you no later than 60 days after we sent the FIRST statement on which the problem or error appeared.

(1) Tell us your name and account number (if any)

(2) Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information.

(3) Tell us the dollar amount of the suspected error.

If you tell us orally, we may require that you send us your complaint or question in writing within 10 business days.

We will determine whether an error occurred within 10 business days (20 business days if the transfer involved a new account) after we hear from you and will correct any error promptly. If we need more time, however, we may take up to 45 days (90 days if the transfer involved a new account, a point-of-sale transaction, or a foreign-initiated transfer) to investigate your complaint or question. If we decide to do this, we will credit your account within 10 business days (20 business days if the transfer involved a new account) for the amount you think is in error, so that you will have the use of the money during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not credit your account. An account is considered a new account for 30 days after the first deposit is made, if you are a new customer.

We will tell you the results within three business days after completing our investigation. If we decide that there was no error, we will send you a written explanation.

You may ask for copies of the documents that we used in

our investigation.

If you have any inquires regarding your account, please

contact us at:

151 N. Main

PO Box 313

Kingman, KS 67068-0313

BUSINESS DAYS: Monday, Tuesday, Wednesday, Thursday and Friday

Holidays are not included.

PHONE: (620) 532-5821

NOTICE OF ATM/NIGHT DEPOSIT FACILITY USER PRECAUTIONS

As with all financial transactions, please exercise discretion when using an automated teller machine (ATM) or night deposit facility. For your own safety, be careful. The following suggestions may be helpful.

1. Prepare for your transactions at home (for instance, by filling out a deposit slip) to minimize your time at the ATM or night deposit facility.

2. Mark each transaction in your account record, but not while at the ATM or night deposit facility. Always save your ATM receipts. Don’t leave them at the ATM or night deposit facility because they may contain important account information.

3. Compare you records with the account statements you receive.

4. Don’t lend your ATM card to anyone.

5. Remember, do not leave your card at the ATM. Do not leave any documents at a night deposit facility.

6. Protect the secrecy of your Personal Identification Number (PIN). Protect your ATM card as though it were cash. Don’t tell anyone your PIN. Don’t give anyone information regarding your ATM card or PIN over the telephone. Never enter your PIN in any ATM that does not look genuine, has been modified, has a suspicious device attached, or is operating in a suspicious manner. Don’t write your PIN where it can be discovered. For example, don’t keep a note of you PIN in your wallet or purse.

7. Prevent others from seeing your PIN by using your body to shield their view.

8. If you lose your ATM card or if it is stolen, promptly notify us. You should consult the other disclosures you have received about electronic fund transfers for additional information about what to do if you card is lost or stolen.

9. When you make a transaction, be aware of your surroundings. Look out for suspicious activity near the ATM or night deposit facility, particularly if it is after sunset. At night, be sure that the facility (including the parking area and walkways) is well lighted. Consider having someone accompany you when you use the facility, especially after sunset. If you observe any problem, go to another ATM or night deposit facility.

10. Don’t accept assistance from anyone you don’t know when using an ATM or night deposit facility.

11. If you notice anything suspicious or if any other problem arises after you have begun an ATM transaction, you may want to cancel the transaction, pocket your card and leave. You might consider using another ATM or coming back later.

12. Don’t display your cash; pocket it as soon as the ATM transaction is completed and count the cash later when you are in the safety of your own car, home, or other secure surrounding.

13. At a drive-up facility, make sure all the car doors are locked and all of the windows are rolled up, except the driver’s window. Keep the engine running and remain alert to your surroundings.

14. We want the ATM and night deposit facility to be safe and convenient for you. Therefore, please tell us if you know of any problem with a facility. For instance, let us know if a light is not working or there is any damage to a facility. Please report any suspicious activity or crimes to both the operator of the facility and the local law enforcement officials immediately.

MORE DETAILED INFORMATION IS AVAILABLE ON REQUEST

Your Ability To Withdraw Funds

Our policy is to make funds from your cash and check deposits available to you immediately. At that time, you can withdraw the funds in cash and we will use the funds to pay checks that you have written.

Please remember that even after we have made funds available to you and you have withdrawn the funds, you are still responsible for checks you deposit that are returned to us unpaid and for any other problems involving your deposit.

Determining the Availability of a Deposit

For determining the availability of your deposits, every day is a business day, except Saturdays, Sundays, and federal holidays. If you make a deposit before closing on a business day that we are open, we will consider that day to be the day of your deposit. However, if you make a deposit after closing or on a day we are not open, we will consider that the deposit was made on the next business day we are open.

Longer Delays May Apply

Case-By-Case Delays – In some cases, we will not make all of the funds that you deposit by check available to you immediately. Depending on the type of check that you deposit, funds may not be available until the second business day after your deposit. The first $200 of your deposits, however, may be available immediately.

If we are not going to make all of the funds from your deposit available immediately, we will notify you at the time you make your deposit. We will also tell you when the funds will be available. If your deposit is not made directly to one of our employees, or if we deicide to take this action after you have left the premises, we will mail you the notice by the first business day after we receive your deposit.

If you will need the funds from a deposit right away, you should ask us when the funds will be available.

Safeguard Exception Delays – Funds you deposit by check may be delayed for a longer period under the following circumstances:

We believe a check you deposit will not be paid.

You deposit checks totaling more than $5,000 on any one day.

You re-deposit a check that has been returned unpaid.

You have overdrawn your account repeatedly in the last six months.

There is an emergency, such as failure of computer or communications equipment.

We will notify you if we delay your ability to withdraw funds for any of these reasons, and we will tell you when the funds will be available. They will generally be available no later than the seventh business day after the day of your deposit.

Special Rules for New Accounts

If you are a new customer, the following special rules will apply during the first 30 days your account is open:

Funds from electronic direct deposits to your account will be available on the day we receive the deposit. Funds from deposits of cash, wire transfers, and the first $5,000 of a day’s total deposits of cashier’s, certified, teller’s, traveler’s, and federal, state and local government checks will be available on the first business day after the day of your deposit, if the deposit meets certain conditions. For example, the checks must be payable to you (and you may have to use a special deposit slip). The excess over $5,000 will be available on the ninth business day after the day of your deposit. If your deposit of these checks (other than a U.S. Treasury check) is not made in person to one of our employees, the first $5,000 will not be available until the second business day after the day of your deposit.

Funds from all other check deposits will be available on the 7th business day after the day of your deposit.

Truth-In-Savings

KANZA REWARDS CHECKING

Important Account Information for our Customers

From

KANZA Bank 151 N. Main

P.O. Box 313

Kingman, KS 67068-0313

620-532-5821

Rate information – At our discretion, we may change the interest rates for this account.

Tier 1 – An interest rate of 1.980% will be paid on the entire portion of your daily balance that is less than $10,000.01. The annual percentage yield (APY) for this tier is 2.00% Tier 2 – An interest rate of .50% will be paid only for that portion of your daily balance that is $10,000.01 or more.

The interest rates and annual percentage yields may change daily.

Compounding frequency – Interest will be compounded monthly.

Crediting frequency – Interest will be credited into this account monthly.

Effect of closing an account – If you close your account before interest is paid, you will not receive accrued interest.

Daily balance computation method – Interest is calculated by the daily balance method which applies a daily periodic rate to the balance in the account each day.

Accrual of interest on noncash deposits – Interest will begin to accrue on the business day you deposit noncash items (for example, checks) into your account.

Minimum balance to open – The minimum balance required to open this account is $100.00.

Deposit limitations – You may make an unlimited number of deposits into your account.

Additional Terms – The following additional terms apply to this account:To receive the high Annual Percentage Yield and ATM refunds nationwide, you must perform the following qualifications per qualification cycle:

- 12 debit card purchases must post and clear your account monthly.

- At least one direct deposit or ACH Auto Debit must post and clear your account monthly.

- Receive e-Statements.

If you do not meet the qualifications during the qualification cycle, your account will still function as a free checking account earning 0.05% APY and you will not receive ATM refunds for that time period.

With KANZA Rewards Checking, you will receive:

- Free Online Banking

- Free, Unlimited Bill Payment

- Free e-Statements

-ATM Fee Refunds Nationwide (if qualifications are met)

Availability Limitations:

This account type is available for personal account use only. New customer applicants must reside in Kansas or Oklahoma.

Statement Cycle & Qualitication Cycle:

Statements for KANZA Rewards accounts will cycle with a cutoff date of the 16th unless the 16th falls on a weekend or Federal Holiday, in which case the statement will cycle on the first business day thereafter. Qualification requirements (i.e. 12 debit card purchases posted and cleared, and a direct deposit or ACH Auto Debit posted and cleared) for determining if the account will receive the high annual percentage yield (APY) are calculated the business day prior to the statement cycle date. Therefore, the cutoff date for the "qualification cycle" will always be the business day just prior to the day the statements cycle. Debit card and other electronic transactions are counted based on the date that the transaction hard posts and clears the account rather than the date the transaction was conducted by the customer. Any debit card purchases and direct deposit/ACH activity occurring on the statement cycle date will be counted in the following month’s qualification calculations. For example, if the statement date is March 16th, debit card purchases and ACH activity that are posted and cleared to that statement with a date of March 16th will be counted in the next statement’s qualifications.

Numerous, very small dollar transactions discouraged - The KANZA Rewards account is designed to provide an attractive rate of interest for customers who choose to conduct much of their banking electronically, which is a cost-effective method for us. KANZA Bank reserves the right to close any customer account, upon reasonable notification, at any time and for any reason (see terms and conditions.) Customers that attempt to qualify for the high rate of interest yield by making numerous, very small dollar transactions are not conducting their account activity consistently with account expectations for this product. When customers choose to handle their KANZA Rewards account in this manner, then KANZA Bank may choose to close the customer account or request that the customer change their account type to a product more consistent with their account practices.

REGULAR CHECKING

Minimum balance to open - The minimum balance required to open this account is $100.

Deposit limitations - You may make an unlimited number of deposits into your account.

Fees and Charges - The following fees and charges apply to this account:

Service Charge: $5 per month if $500 average daily balance is not maintained.

Additional Terms - The following additional terms apply to this account: The average daily balance is calculated by adding the principal in the account for each day of the period and dividing that figure by the number of days in the period.

FREE CHECKING

Minimum balance to open the account - You must deposit $100 to open this account.

Deposit Limitations - You may make an unlimited number of deposits into your account.

Additional Terms - The following additional terms apply to this account: Duplicate checks are required, as check images are not included with the statement.

RELATIONSHIP CHECKING

Rate information - At our discretion, we may change the interest rate for this account. The interest rate and annual percentage yield may change at any time.

Compounding frequency - Interest will be compounded monthly.

Crediting frequency - Interest will be credited into this account monthly.

Effect of closing an account - If you close your account before interest is paid, you will not receive the accrued interest.

Daily balance computation method - Interest is calculated by the daily balance method which applies a daily periodic rate to the balance in the account each day.

Accrual of interest on noncash deposits - Interest will begin to accrue on the business day you deposit noncash items (for example, checks) into your account.

Minimum balance to open - The minimum balance required to open this account is $100.

Minimum balance to obtain the disclosed annual percentage yield - You must maintain a minimum daily balance of $2,500 in your account each day to obtain the disclosed annual percentage yield.

Minimum balance to avoid Service Charge - A daily combined balance of any of the following consumer (non-business) accounts: checking, savings, money market, certificates of deposit, individual retirement accounts, consumer loans, home equity line of credit, and KANZA Bank mortgage loans, must equal a minimum of $10,000 to avoid a monthly $10 service fee. The combined relationship balance is determined by adding the low balance within the cycle for each account in the relationship.

Deposit limitations - You may make an unlimited number of deposits into your account.

Additional Terms - The following additional terms apply to this account: Unlimited check writing, free Total Rewards checks (limits may apply), free online banking and bill payment(some limits may apply), new consumer loans with auto pay at a discounted rate, waive five foreign (non KANZA Bank) ATM Charges per month, one year free safe box rental with automatic debit from a KANZA Bank account, free cashier's checks, free basic travelers checks, three discounted PrimeVest trades and complimentary financial consultation, combined statements for all accounts, and $1,000 overdraft privilege limitation.

INTEREST CHECKING ACCOUNT

Rate Information - Your interest rate and annual percentage yield may change. Frequency of rate changes - We may change the interest rate on your account at any time.

Determination of rate - At our discretion, we may change the interest rate on your account.

Compounding and crediting frequency - Interest will be compounded every month. Interest will be credited to your account every month.

Effect of closing an account - If you close your account before interest is credited, you will not receive the accrued interest.

Minimum balance to open the account - You must deposit $1,000 to open this account.

Minimum balance to avoid imposition of fees - A service charge fee of $5 will be imposed each monthly statement cycle if the minimum ledger balance for the monthly statement cycle falls below $1,000.

Minimum balance to obtain the annual percentage yield disclosed - You must maintain a minimum balance of $1,000 in the account each day to obtain the disclosed annual percentage yield.

Daily balance computation method - We use the daily balance method to calculate the interest on your account. This method applies a daily periodic rate to the principal in the account each day. Interest will not accrue if daily ledger balance falls below $1,000.

Accrual of interest on non-cash deposits - Interest begins to accrue no later than the business day we receive credit for the deposit of non-cash items (for example, checks).

Fees: A per item fee of $.20 will be charged for each debit transaction in excess of 25 during a month. This fee will apply if the minimum ledger balance falls below $1,000.

MONEY MARKET ACCOUNT

Rate Information - Your interest rate and annual percentage yield may change. Frequency of rate changes - We may change the interest rate on your account at any time.

Determination of rate - At our discretion, we may change the interest rate on your account.

Compounding and crediting frequency - Interest will be compounded every month. Interest will be credited to your account every month.

Effect of closing an account - If you close your account before interest is credited, you will not receive the accrued interest.

Minimum balance to open the account - You must deposit $1,000 to open this account.

Minimum balance to avoid imposition of fees - A service charge fee of $5 will be imposed every statement cycle if the balance in the account falls below $1,000 any day of the cycle.

Minimum balance to obtain the annual percentage yield disclosed - You must maintain a minimum balance of $1,000 in the account each day to obtain the disclosed annual percentage yield.

Daily balance computation method - We use the daily balance method to calculate the interest on your account. This method applies a daily periodic rate to the principal in the account each day.

Accrual of interest on non-cash deposits - Interest begins to accrue no later than the business day we receive credit for the deposit of non-cash items (for example, checks).

Transaction limitations: Transfers from a Money Market account to another account or to third parties by preauthorized, automatic, telephone, or computer transfer are limited to six per month with no more than three by check, draft, debit card, or similar order to third parties.

Fees: An excess activity fee of $10 will be charged if there are more than three preauthorized debits or checks per month.

SAVINGS ACCOUNT

Rate Information - Your interest rate and annual percentage yield may change. Frequency of rate changes - We may change the interest rate on your account at any time.

Determination of rate - At our discretion, we may change the interest rate on your account.

Compounding and crediting frequency - Interest will be compounded every day. Interest will be credited to your account quarterly.

Effect of closing an account - If you close your account before interest is paid; you will not receive the accrued interest.

Minimum balance to open the account - You must deposit at least $100 to open a savings account.

Daily balance computation method - We use the daily balance method to calculate the interest on your account. This method applies a daily periodic rate to the balance in the account each day.

Accrual of interest on non-cash deposits - Interest begins to accrue on the business day you deposit non-cash items (for example, checks) into your account.

Transaction limitations: During any calendar month or statement cycle of at least four weeks, you may not make more than six withdrawals or transfers to another account of yours or to a third party by means of a preauthorized or automatic transfer or telephone order or instruction. No more than three of the six transfers may be made by check, draft, debit card (if applicable) or similar order to a third party. If you exceed the transfer limitations set forth above in any statement period, your account will be subject to closure by the financial institution.

Fees: A service charge fee of $1 will be charged for each debit transaction (including all electronic debits) in excess of four during a calendar month.

A $10 fee may be imposed if a current KANZA Bank accountholder fails to maintain a $50 balance throughout the entire month, for purposes of cashing foreign checks of $100 or more.

A $5 per month fee may be imposed if a $100 average daily balance is not maintained.

We may require not less than 7 days' notice in writing before each withdrawal from an interest-bearing account other than a time deposit, or from any other savings account as defined by Regulation D. Withdrawals from a time account prior to maturity or prior to any notice period may be restricted and may be subject to penalty. See your notice of penalty for early withdrawal.

The categories of transactions for which an overdraft fee may be imposed are those by any of the following means: check, in-person withdrawal, ATM withdrawal, or other electronic means.

Important Information about Procedures for Opening a New Account

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license or other identifying documents.

Overdraft Privilege

Service Description

It is the policy of KANZA Bank (heretofore also referred

to as "the Bank," "we," "our"

or "us") to comply with applicable laws and

regulations, and to conduct business in accordance with

applicable safety and soundness standards.

Our normal insufficient funds or overdraft charge of $30* will apply to each item that would create an overdraft on your account. The categories of transactions for which overdrafts and resulting overdraft fees may be imposed include checks; in-person withdrawals; ATM withdrawals, debit card transactions, preauthorized automatic debits, electronic checks, telephone-initiated transfers, or other electronic transfers; payments authorized by you; the return, unpaid, of items deposited by you; the imposition of bank service charges; or the deposit of items which according to our Funds Availability Policy, are treated as not yet "available" or finally paid. Our insufficient funds and overdraft charges are per item fees. Therefore, more than one insufficient or overdraft fee could be charged against the account per day. Of course, we are not promising to pay your overdrafts, not all accounts are eligible, and some restrictions do apply.

We are not obligated to pay any item presented for payment if your account does not contain sufficient collected funds. Rather than automatically returning any unpaid or any insufficient funds items that you may have, if your eligible account (primarily used for personal and household purposes) has been open for at least thirty (30) business days and thereafter you maintain your account in good standing, which includes at least: (A) Continuing to make deposits consistent with your past practices, (B) You are not in default on any loan obligation to KANZA Bank, (C) You bring your account to a positive balance (not overdrawn) at least once every thirty-five (35) calendar days, and (D) Your account is not the subject of any legal or administrative order or levy, we will consider – as a discretionary courtesy or service** and not a right of yours nor an obligation on our part – approving your reasonable overdrafts. This discretionary service** will generally be limited to a $400 overdraft (negative) balance for Free Checking accounts, a $1,000 overdraft (negative) balance for Relationship Checking accounts, $700 overdraft (negative) balance for KANZA Rewards and other eligible personal checking accounts. Of course, fees charged for covering overdrafts, as well as the amount of the overdraft item, will be subtracted from any Overdraft Privilege limit disclosed.

We may refuse to pay an overdraft for you at any time, even though your account is in good standing and even though we may have previously paid overdrafts for you. You will be notified by mail of any insufficient funds items paid or returned that you may have; however, we have no obligation to notify you before we pay or return any item. KANZA Bank reserves the right to demand immediate payment of any overdrafts plus our insufficient funds and/or overdraft charge(s) that you owe us. If there is an overdraft paid by us on an account with more than one (1) owner on the signature card, each owner, and agent if applicable, drawing/presenting the item creating the overdraft, shall be jointly and severally liable for such overdrafts plus our insufficient funds and/or overdraft charge(s).

Overdraft Privilege is one more way KANZA Bank works for you and a great reason for banking with us. You have the option of declining this program. If you have any questions or wish to decline this service, please call 1.888.532.5821 and ask to speak with one of our helpful customer service representatives.

LIMITATIONS: Available only to eligible personal checking accounts primarily used for personal and household purposes (Business accounts and Money Market accounts are not eligible) and we may limit the number of accounts eligible for the Overdraft Privilege service** to one account per household.

*This fee may change. Daily

overdraft fee of $5 per business day after three (3) consecutive

business days overdrawn also applies.

**The Overdraft Privilege Service does not constitute an

actual or implied agreement between you and the Bank, nor

does it constitute an actual or implied obligation of or

by the Bank. This service represents a purely discretionary

courtesy or privilege that the Bank may provide to you from

time to time and which may be withdrawn or withheld by the

Bank at any time without prior notice or reason or cause.

At any time, you may request that this service be removed

from your account.

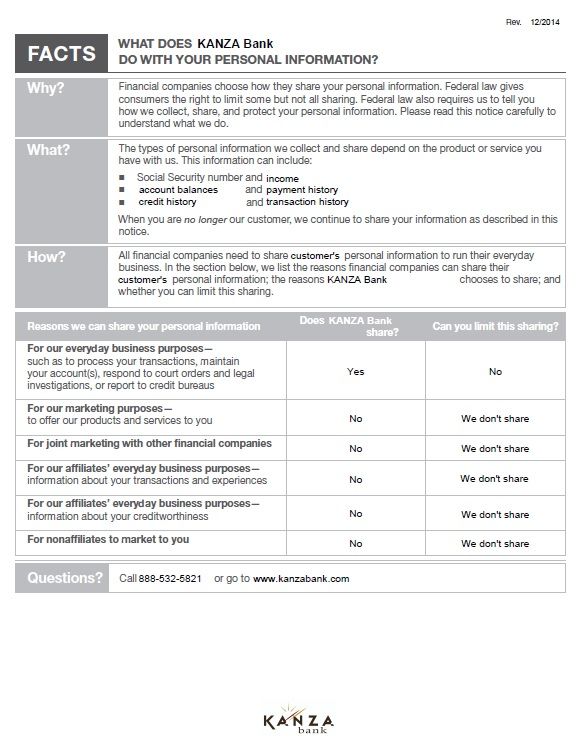

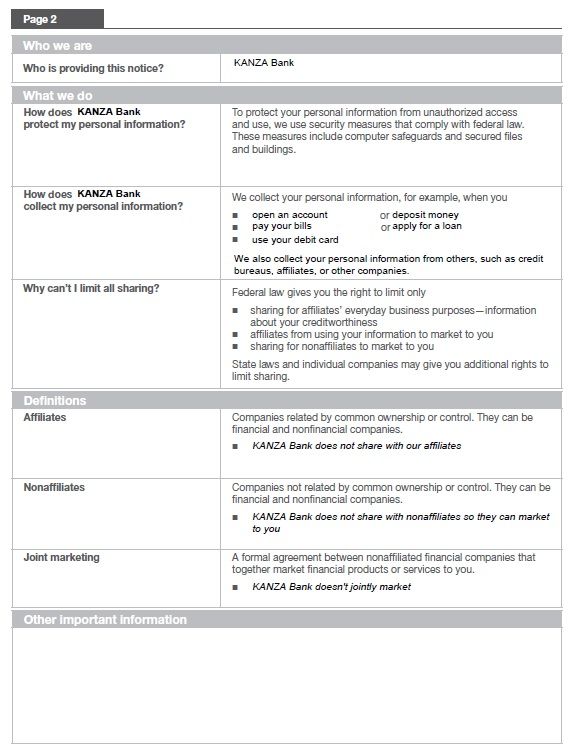

Financial Privacy Policy Notice

SAFE Act Notification

Secure and Fair Enforcement for Mortgage Licensing Act of 2008 ("SAFE Act") Notification

The SAFE Act requires residential mortgage loan originators employed by financial institutions to be registered and assigned unique identifiers with the nationwide Mortgage Licensing System and Registry ("NMLS"). You may view a listing of KANZA Bank's registered mortgage loan originators and their unique identifiers below.

Dawn Byers - NMLS # 641934

Brent Groves - NMLS # 641925

Michelle Green - NMLS # 1148623

Scott Lawrence - NMLS # 641929

Terry Gorges - NMLS # 1861748

Todd Loescher - NMLS # 641928

Greg Schreiner - NMLS # 641930

Jake Baird - NMLS # 757540

Julie Graber - NMLS #1777205

Drew Barry - NMLS # 1756271

Fee Schedule

Services that may come with your account are provided below. Visit www.kanzabank.com for the latest listing of other account services and pricing.

| General Services | ||

|---|---|---|

| Account Closed within 90 Days | If your account is closed within 90 days from the opening date, a fee will be assessed. | $25 per account |

| Account Research | Includes account balancing and multiple copy request. One hour minimum. | $25 per hour |

| Cashier's Checks | Check issued by KANZA Bank. | $5 each |

| Check Collection | Service provided when KANZA Bank directly collects funds from another bank for a check made payable to you; or, for any check made payable to you that is drawn on an international bank | $15 domestic $30 foreign |

| Checking Supplies | Checks, deposit slips or other banking supplies ordered for your account. | Ask us for pricing |

| Counter Checks | A check provided to you at one of our locations when you are in between orders. | $1 each |

| Dormant Account | When your account has had no activity (deposits or withdrawals) for 6 months for checking accounts, or 18 months for savings accounts and money market accounts. | $10 per month |

| Foreign Currency Order | When you want U.S. currency exchanged for foreign currency. | $10 per order |

| Inactive Account | When your account has had no activity (deposits or withdrawals) for 6 months for checking accounts, or 18 months for savings accounts and money market accounts. | $10 per month |

| Legal Processing | Processing of any garnishment, tax levy, or other court administrative order, whether or not the funds are actually paid as allowed by state law. | $15 per partial satisfied $50 per fully satisfied |

| Notary Service | Notary services for non-customers. | $5 per visit |

| Returned Deposit Item | An item you deposit, or check cashed that is returned unpaid. | $5 each |

| Statement Copy | Additional copies of a statement, mailed, faxed or picked up at a location. Online statements are available at no cost. | $5 each |

| Stop Payment | Single item or series of checks, direct debits or bill payments (6 month duration). | $30 each |

| Undeliverable Deposit Statement | A deposit statement that has been returned by USPS to KANZA Bank due to an incorrect address. Assessed each time a deposit statement is returned to KANZA Bank. | $10 per statement |

| ATM & Debit Card Services | ||

| Non-KANZA Bank ATM Transactions | A withdrawal or balance inquiry at an ATM location that is not owned by KANZA Bank. | $1 per transaction |

| International Processing (U.S. Dollars) | A transaction made outside the U.S. using a KANZA Bank card. | 2.00% of card transaction amount |

| Rush ATM & Debit Card Replacement | Rush delivery in 1 to 2 business days of your ATM or Debit Card. | $100 per card |

| Overdraft Services | ||

| NOTE: Insufficient funds may be created by check, ATM withdrawal, in-person withdrawal, transfer or other electronic means. Overdraft paid item fees will not occur on ATM and everyday debit card transactions unless you authorize us to pay overdrafts on these transactions. | ||

| Overdraft Paid Item | An item that has been paid against insufficient funds in your account. We will not charge for an Overdraft Paid Item if your ending account balance is overdrawn by $5.00 or less. | $30 per item |

| Non-sufficient Funds (NSF) Returned Item | An item that has been returned due to insufficient funds in your account. | $30 per item |

| Daily Maximum Overdrafts / NSF | If multiple items are presented in one business day, we will limit the number of those fees to no more than 5, or $150. Excludes business accounts. | 5 ($150) |

| Overdraft Transfer | When your account is linked to a savings, money market, line of credit or other checking accounts, we will transfer available funds to prevent an overdraft charge. | $5 per transfer |

| Wire Transfer Services | ||

| Incoming Domestic | A transfer of funds into your account from anywhere in the U.S. | $15 each |

| Incoming International | A transfer of funds into your account from anywhere outside the U.S. | $50 each |

| Outgoing Domestic | A transfer of funds out of your account to anywhere in the U.S. | $30 each |

| Outgoing International | A transfer of funds out of your account to anywhere outside of the U.S. | $50 each |

| Safe Deposit Box | ||

| Safe Deposit Box | Box sizes and size availability vary by location. | Ask us for pricing |

| Late Payment | When payment has not been received by the schedule due date this fee will apply. | $10 per box |

| Lost/Missing Key | Lost or missing keys at the time of box closing. | $50 per key |

| Drilling | Drilling of locks because of missing/lost keys, box holder death or other reasons requested by customer. | $150 plus fees associated with drilling |